Advertiser relationships don’t affect card scores or our Editor’s Greatest Card Picks. Credit score Card Insider has not reviewed all obtainable financial institution card provides out there. Content material is not equipped or commissioned by any bank card issuers.

To stay away from falling behind any additional, name your collectors to arrange apayment plan. It simply takes time, diligence, and studying new habits to stay credit-savvy and accountable. So which state of affairs is worse — not having any credit score or having low credit score? “Neither is sweet,” says Greg Reeder, CFP, a monetary advisor with McClarren Monetary Advisors in State Faculty, Pennsylvania.

Understanding Your Credit score Rating

Getting enterprise debt off private playing cards may suggest wanting into completely different choices for enterprise financing, or starting with a enterprise secured card. A supplier might be very helpful when buying for home loans with low credit score.

(Or every!) It happens.The monetary system is solely now recovering from some really highly effective events. Numerous folks have low credit score today- even individuals who till these days have had excellent credit score.

In case you may have poor credit score, you’re starting from beneath flooring stage and it takes longer to enhance,” Reeder says. By placing a substantial upfront price within the route of your automobile buy, you’ll lastly reduce your wonderful debt incurred by financing. It’s, subsequently, usually a good suggestion to set cash aside in your automotive or truck financing down value. Within the months predominant as much as your low credit score automotive finance software program, you need to present additional consideration to your credit score historical past and have to be additional cautious to stay away from additional low credit score listings. We’re so sorry to listen to you will have been turned down for the cardboard you wished.

You should on a regular basis ask a lender if they’re doing a “onerous pull” or a “comfortable pull” in your credit score to be sure you protect your score. It’s going to primarily be comparable to you not at all acquired that assortment, and it’ll enhance your credit score rating quick and provides lenders one much less trigger to say no you.

- Each lender has its private formulation for calculating hazard, however most embrace credit score rating, wonderful money owed, income, job standing and debt-to-revenue ratio in arriving on the risk subject.

- There will not be any shortcuts to establishing a very good credit score historical past; it takes time and making common funds to your accounts.

- If it’s worthwhile to borrow $25,000 with a poor credit standing, you’ll pay round 12{c77e80f580868faa8c74820afc79c644505b70a73023dbc29c3d004248d8e764} curiosity on a 60-month mortgage.

The primary are merely widespread lenders who deal in merchandise comparable to FHA or VA loans, which have a lot much less stringent credit score necessities than customary mortgages. Damaging objects solely preserve in your credit score report for seven years, so when you’ll be able to preserve all of your accounts in good standing for that lengthy, your credit score is likely to be cleaned.

It might be because of pure financial mismanagement, however it may well merely as merely be the outcomes of the difficulties of life. A divorce, the onset of a extreme illness, or occupation catastrophe can flip good credit score into low credit score in brief order. Are you obtainable out there for a brand new or used car, however are involved you will not be accredited for an auto mortgage attributable to your credit score rating? Our Credit score Approval Assure program might enable you to secure auto financing, it doesn’t matter what your credit standing is also. By putting a sizeable upfront value in your automobile purchase, you will lastly cut back your excellent debt incurred by financing.

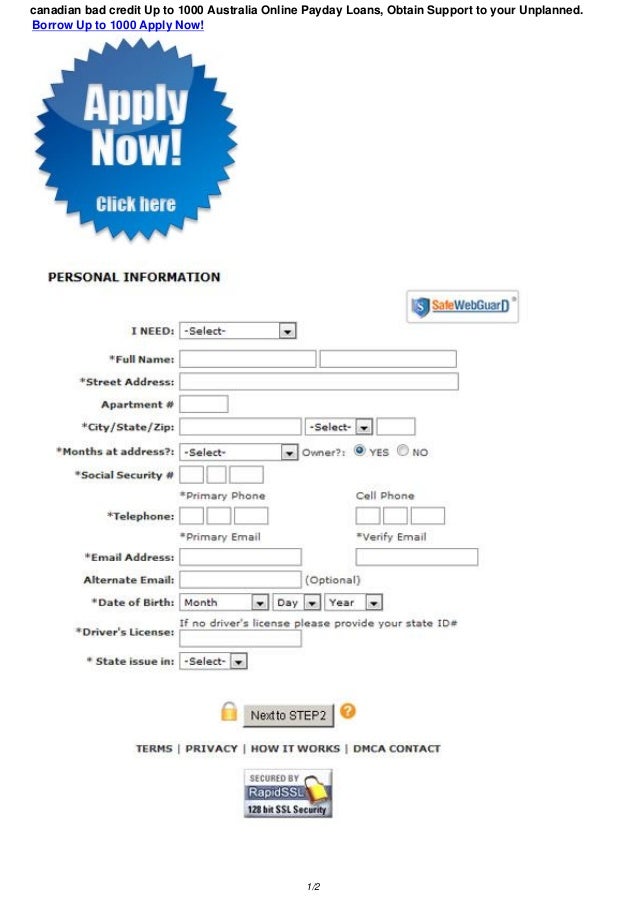

Cheap efforts are made to maintain up correct information, although all bank card information is launched with out assure. While you click on on any ‘Apply Now’ button, in all probability essentially the most up-to-date phrases and conditions, expenses, and fee information shall be supplied by the issuer.

LendingPoint: Greatest for Installment Loans

The one exception is a Chapter 7 chapter, which could keep in your report for as much as 10 years. This is a normal approximation of the vary of credit score scores.