Credit score Sesame, a platform for managing loans and credit score scores, picks up $43M en path to IPO

Installment Credit score

Whereas we try to supply a variety presents, Bankrate does not embody particulars about every financial or credit score services or products. Banks earn cash by lending cash to debtors and charging some rates of interest. So, it is vitally essential from the financial institution’s half to watch the cardinal concepts of lending. When these guidelines are abided, they assure the safety of banks’ funds and in response to that they assure its depositors and shareholders.

The collector must also have the flexibility to furnish a minimal of the final 4 digits of your Social Safety amount. In most states, money owed can keep in your credit score report longer than collectors can drive assortment. So a debt listed in your credit score historic previous doesn’t routinely imply that the collector can compel you to pay it. Simply on account of the debt is listed there doesn’t imply it actually is yours.

As the first provide of funds for a monetary establishment is the money deposited by its prospects which can be repayable as and when required by the depositors, the financial institution have to be very cautious whereas lending money to shoppers. Due to this fact, from the monetary establishment’s technique of perceiving, the character of security could also be very important whereas lending a mortgage. Even after contemplating the securities, the monetary establishment should look at the creditworthiness of the borrower which is monitored by his character, capability to repay, and his monetary standing. Above all, the safety of financial institution funds is determined by the technical feasibility and financial viability of the enterprise for which the mortgage is to be given. Additionally, the share and debentures of business points are certain to their earnings.

On this complete course of, banks earn good income and develop as monetary institutions. Sound lending guidelines by banks moreover help the monetary system of a nation to prosper and as well as promote development of banks in rural areas. Now lending money to somebody is accompanied by some dangers primarily. As everyone knows that monetary establishment lends the cash of its depositors as loans. To place it merely the principle job of a monetary establishment is to lease money from depositors and provides money to the debtors.

- The Enterprise Administration focus inside the Grasp of Arts diploma in Management is comprised of the next packages.

- Word that making a partial charge, a price association, or accepting a settlement provide on an earlier debt can restart the statute of limitations.

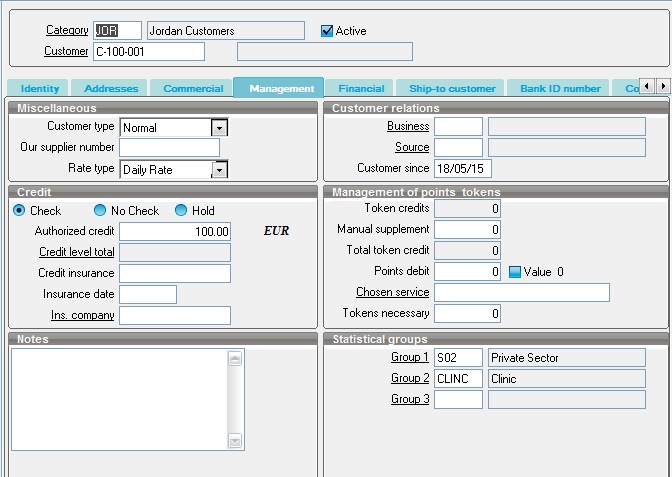

- Credit score management is the system utilized by companies and central banks to make certain that credit score is given solely to debtors who’re probably to have the ability to repay it.

Extra shopper safety authorized pointers embrace the Phone Shopper Safety Act (TCPA) and the Shopper Monetary Safety Act (CFPA). It could be a replica of your contract with the distinctive creditor, a reproduction of the charge-off assertion or an bill from the distinctive creditor. Or it could merely be details about the debt, like the unique creditor’s title, the account quantity, charge-off amount and current stability.

Most corporations ship out reminders on 30, 60 and 90 days after which take extra motion for non-cost. Your credit score controller ought to go to your clients usually to chase for value in order that any disputes on payments are picked up early.