But 26 million Individuals are “credit score invisible,” which implies they don’t have any credit score. One other 19 million are considered “unscorable” because of their credit score historic previous is insufficient or not present. A present Bankrate survey reveals that higher than half of individuals between 18 and 29 years outdated don’t have a bank card. Nevertheless, auto mortgage seekers can nonetheless get unfavorable credit ratings auto loans at a lower rate of interest within the occasion that they examine to repair their credit score historical past earlier than getting behind the wheel of their subsequent automotive. This type of automobile mortgage might have bigger rates of interest, and ultimately might lead to being overcharged for having a poor credit standing.

The phrases represented listed below are based mostly totally on sure assumptions outlined below and/or famous on the mortgage define internet web page. Further particulars regarding privateness, program disclosures, licensing specifics may be discovered at migonline.com Authorized Data. A secured bank card is a bank card that requires a security deposit. The quantity of the security deposit is the amount of credit score you could have entry to. As an example, in case your deposit is $400, you’ll have entry to $400 in credit score.

A tarnished credit score historic previous makes it extra sturdy to protected your monetary targets down the highway. It could look like everyone you realize has a number of bank cards or is paying off a mortgage.

Customers who’re considered much less harmful pay much less in premiums than these thought of excessive hazard. Since your credit score historical past is a reflection of how financially accountable you may be, insurance coverage protection companies imagine that moreover it’s a reflection of how accountable you may be whereas driving.

As your credit score improves with accountable card use, lastly you’ll qualify for extra rewarding financial institution playing cards. You possibly can on a regular basis examine to see in case you’re pre-qualified for any cardswithout hurting your credit score scores in any respect. Your fee historic previous accounts for 35{c77e80f580868faa8c74820afc79c644505b70a73023dbc29c3d004248d8e764} of your FICO scores, and the one strategy to determine a constructive credit score historical past is to continually make on-time funds over a protracted interval. Being late on the lease or not paying down your bank card debt might not look like a giant deal, nevertheless an accumulation of late or missed fee dings can really begin to weaken your credit score historic previous.

- On-line installment loans are designed to help once you need a brief-time interval mortgage quick and have unfavorable credit ratings and even no credit score.

- In the event you discover discrepancies collectively together with your credit score rating or info out of your credit score report, please contact TransUnion® straight.

- In the event you’ve obtained mailers from financial institution playing cards or mortgage companies saying you’re pre-permitted, you have expert a mild inquiry.

- In idea, an FHA lender may be shut down as a result of the FHA lender all through the road raised its minimal credit score rating requirement from 640 to 680.

- We hope you could begin an everlasting and energetic relationship with Masson Patout Automotive Group by submitting a safe, on-line, credit score software program shortly.

- Critiques aren’t provided or commissioned by the bank card, financing and restore companies that seem on this website online.

Enterprise bank cards for unfavorable credit ratings are a sensible choice for brand new or established enterprise householders seeking to make purchases on credit score and bolster their private scores. However primarily essentially the most rewarding enterprise financial institution playing cards are typically reserved for the bottom-threat candidates. Do not anticipate any type of assured approval for unfavorable credit ratings mortgages – there is no such factor. Typically, the problem with unfavorable credit ratings home loans isn’t a lot qualifying for them, however paying the value.

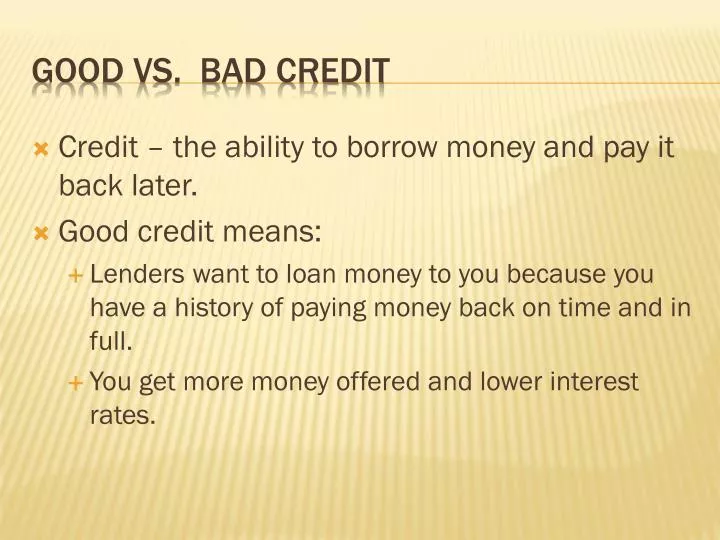

Sadly, the outcomes of unfavorable credit ratings – extreme charge of curiosity prices on financial institution playing cards, auto and residential loans, even deposits for housing and utilities – are what maintain people in debt. It’s a vicious cycle that feeds on itself and retains buyers from gaining administration of their funds. Sadly, there’s no commonplace reply to, “What’s a nasty credit standing?” That is because of each lender appears to be like at scores otherwise to find out whether or not or not or to not lengthen a mortgage or line of credit score. Based mostly in your current ranking and credit score historic previous, lenders or insurance coverage protection companies might lengthen assorted provides. These with lower credit score scores will typically see higher charges of curiosity or requests to place down deposits.

how do our unfavorable credit ratings automotive loans work?

Lenders often value higher mortgage charges and fees on house loans with unfavorable credit ratings and will require larger down funds as properly. In some situations lenders can even require proof of financial reserves satisfactory to cowl wherever from a number of months to a few years of mortgage funds.

A constructive pay historical past will do wonders in your credit score historic previous! Look to McCarthy Auto Group once you wish to be taught further about your monetary decisions –– we’re proper right here for you. Dangerous Credit score Installment Loans are designed that may make it easier to construct or enhance your credit standing, and typically include superb phrases. First off, you aren’t meant to return the borrowed amount instantly, or instantly. As an alternative, the funds are unfold out over an prolonged interval, so you possibly can take care of them as some other month-to-month bill.