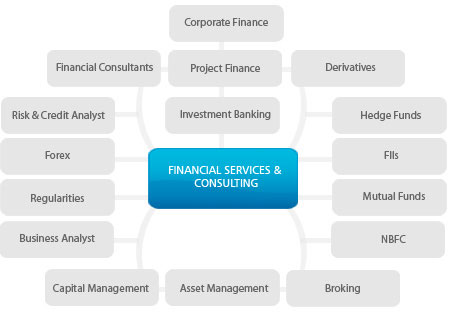

A part of the advisor’s activity is that can allow you to understand what’s concerned in meeting your future targets. The training course of may embrace detailed assist with monetary subjects. In the beginning of your relationship, these topics may presumably be budgeting and saving. As you advance in your data, the advisor will help you in understanding complicated funding, insurance coverage protection, and tax issues. The Certificates in Funding Efficiency Measurement (CIPM) measures your present funding effectivity and helps develop your talents by means of smart features.

There aren’t any formal diploma necessities, and the certification acknowledges that you have handed by way of a rigorous curriculum of ethical requirements, primary funding consciousness, danger administration and charge of return calculations. As a way to enroll on this system, it’s a must to meet their work expertise requirements of a minimum of two years of economic session or accounting corporations. Constancy’s place throughout the rankings additionally fell, though the agency’s total rating went up. For the reason that survey measures direct retail purchasers of corporations’ advisors quite than custodial customers, the outcomes show how Schwab has improved its full-service suggestion over the earlier numerous years, Foy says.

The curricula ought to supply related finance diploma programs masking the concepts of finance and key monetary concepts. Whereas specific courses may differ by school, this system ought to provide coursework in such topics as investments, accounting and statistics for monetary analysts, monetary administration, and evaluation of financial statements. Programs should be designed to assist college students hone such talents as essential pondering and determination-making.

- This designation means your planner has taken rigorous monetary checks, accomplished intensive work expertise and is beholden to the CFP’s Board of Requirements code {of professional} conduct.

- Monetary Planning AssociationThe affiliation supplies particular person memberships to college students, professionals, and school, in addition to group memberships to corporations and organizations.

- And they’ll additionally help you determine when to faucet into Social Safety.

- Nearly all the compensation an funding advisor receives ought to come instantly from his customers.

- Almost eighty{c77e80f580868faa8c74820afc79c644505b70a73023dbc29c3d004248d8e764} of respondents need to asset managers to help them optimize their corporations.

When you transform a CFP, you will be a trusted advisor for people who need assist in monetary planning. You will not solely have the ability to help them of their non-public funds, nonetheless moreover, you’ll help them save taxes and create non-public financial savings.

Why You Must Work With A Monetary Advisor

The important thing distinction between CFA and CFP is the abilities and profession outlook. CFA focusses on enhancing funding administration talents along with funding evaluation, portfolio technique, asset allocation, and company finance.

Whereas, CFP enables you to study all about wealth administration and monetary planning. CFA is probably going one of many hardest monetary credentials you’re going to get on the earth. It has three ranges to get by way of sooner than you’ll be thought-about as CFA whereas, CFP is significantly less complicated must you talk about ranges.